Ninth Resolution of Modifications to the RGCE in Mexico.

On November 23th, the Ninth Resolution of Modifications to the RGCE was published in the Official Journal of the Federation (OJF) in Mexico, highlighting within its modifications the following 8 points:

1.- Postal Form.

It is important to specify that this modification will take effect 2 months after its publication.

2.- Transfer of merchandise between controlled areas in maritime or air customs.

The controlled premises located, either in maritime or air customs, may carry out the transfer of merchandise when it is covered by a Master Air Waybill consigned to a cargo consolidator or deconsolidator, up to three occasions. This measure consists of a facilitation since before it was only allowed up to two occasions and with this it will allow to avoid saturation in rooms and to open spaces.

3.- Authorization for the entry or exit of merchandise from the national territory by a place other than the authorized one.

- Have the permits of the corresponding Dependencies.

- Do not transfer directly to pipes or tank trucks, only through pipelines or for storage.

- Prove that clients have permission to carry out distribution, commercialization, transportation, sale to the public and any other related activity.

- Give the Service Tax Administration (SAT in Spanish) direct access, online and in real time, to the information on inputs and outputs, as well as to inventory control systems.

- Accredit having portable and closed circuit cameras for consultation by the authority in real time.

Authorization maintenance requirements were established, such as:

- Make sure you have current permits.

- Allow authorities at all times access to facilities, equipment and information to carry out reviews and verifications.

- Record the arrival, dispatch and departure of goods with portable cameras or drones, regardless of the recording made through closed circuit television.

- Keep a record of the bills of lading (Bill of Lading) or cargo manifests and the CFDI with a Letter of Carriage supplement.

- Submit the information on volumetric controls.

- Opinion issued by an expert with which to determine the type and quality of the imported or exported hydrocarbon or petroleum, and the octane number in the case of gasoline.

Finally, the adjustments of the third advance were also considered, related to the increase in the cost of this authorization from $ 12,748 to $ 13,173.00 mexican pesos.

4.- Addition of merchandise to Annex 10, Section A, Register of Importers of Specific Sectors, Sector 2, Radioactive and Nuclear.

4 tariff fractions are added, corresponding to elements, devices and instruments for medical and surgical use.

|

28444003 |

Radioactive elements and isotopes and compounds, except those of subheadings 2844.10, 2844.20 or 2844.30; alloys, dispersions (including cermets), ceramic products and mixtures, containing these elements, isotopes or compounds; radioactive waste. |

|

90221901 |

For other uses. |

|

90222102 |

For medical, surgical, dental or veterinary use. |

|

90229099 |

Others. |

5.- Addition of the FC identifier. In Appendix 8 of Annex 22.

This identifier is added at the item level of the request, to specify that the corresponding tariff fraction will be indicated when there is a change in the tariff fraction between the date of entry of the merchandise into national territory and on the date of payment of the current request. Considering keys 1 and 2, to refer to either the fraction of the old rate or the new one, respectively.

6.- Addition of tractors with different specifications as merchandise, for which importation is not required to pay VAT.

The following tractor modalities are added to Annex 27 as a support measure for the agricultural sector:

|

87019201 |

Wheel tractors with power take-off or three-point hitch, for coupling agricultural implements, except those whose serial or model number is at least 2 years prior to the current one and what is included in tariff section 8701.92.02. |

|

87019301 |

Wheel tractors with power take-off or three-point hitch, for coupling agricultural implements, with power greater than 53 CP, except those whose serial number or model is at least 2 years prior to the current one. |

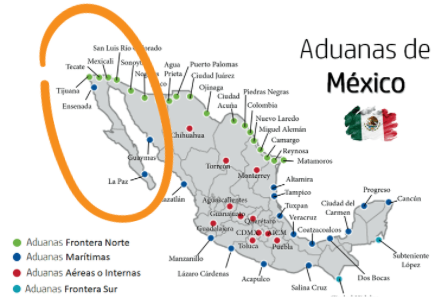

7.- Addition of fiscal routes between customs and sections of Baja California

The following 4 routes are added:

- From Ensenada Customs to Cabo San Lucas Customs Section, dependent on La Paz Customs.

- From Tijuana Customs to the Cabo San Lucas Customs Section, dependent on La Paz Customs.

- From Tecate Customs to Cabo San Lucas Customs Section, dependent on La Paz Customs.

- From the Mexicali Customs to the Customs Section of Cabo San Lucas, dependent on La Paz Customs.

8.- Modification of Customs Hours.

The schedules of the customs sections of the Monterrey customs, and of the Cd de Miguel Alemán and Camargo are modified, with the following changes:

|

Customs / Section

|

Schedule Modification

|

|

Monterrey Customs |

… |

|

General Escobedo Customs Section FF.CC. |

Saturdays from 10:00 to 12:00 hours. |

|

Salinas Victoria B Customs Section (Interport) |

Saturdays from 10:00 a.m. to 2:00 p.m. |

|

Miguel Alemán Customs Office |

Saturdays from 09:00 am to 3:00 pm. |

|

Ciudad Camargo Customs |

Saturdays and Sundays from 10:00 am to 1:00 pm. |