SAT AUDITS TO VIRTUAL OPERATIONS. IN SEARCH OF SIMULATORS.

In the last couple of months, some of our friends and clients have informed us that both the Central and Decentralized Units of the General Administration of Foreign Trade Audit, of the Tax Administration Service, have initiated various foreign trade audit procedures focused on the review of virtual operations.

Consulting directly with the authority, they confirm that the idea of these Audits is to find companies that simulate virtual operations, especially those related to key V1 petitions, through home visits, cabinet reviews and attestations.

BUT WHAT IS THE AUTHORITY REVIEWING?

It is important to point out that as part of the verification powers enjoyed by the foreign trade audit areas of the Tax Administration Service, they can carry out the request for various information related to foreign trade operations, either of those indicated expressly in the order or for a specified period of time.

Is the authority going to visit you and you don't know how to proceed? Contact us here for advice on this.

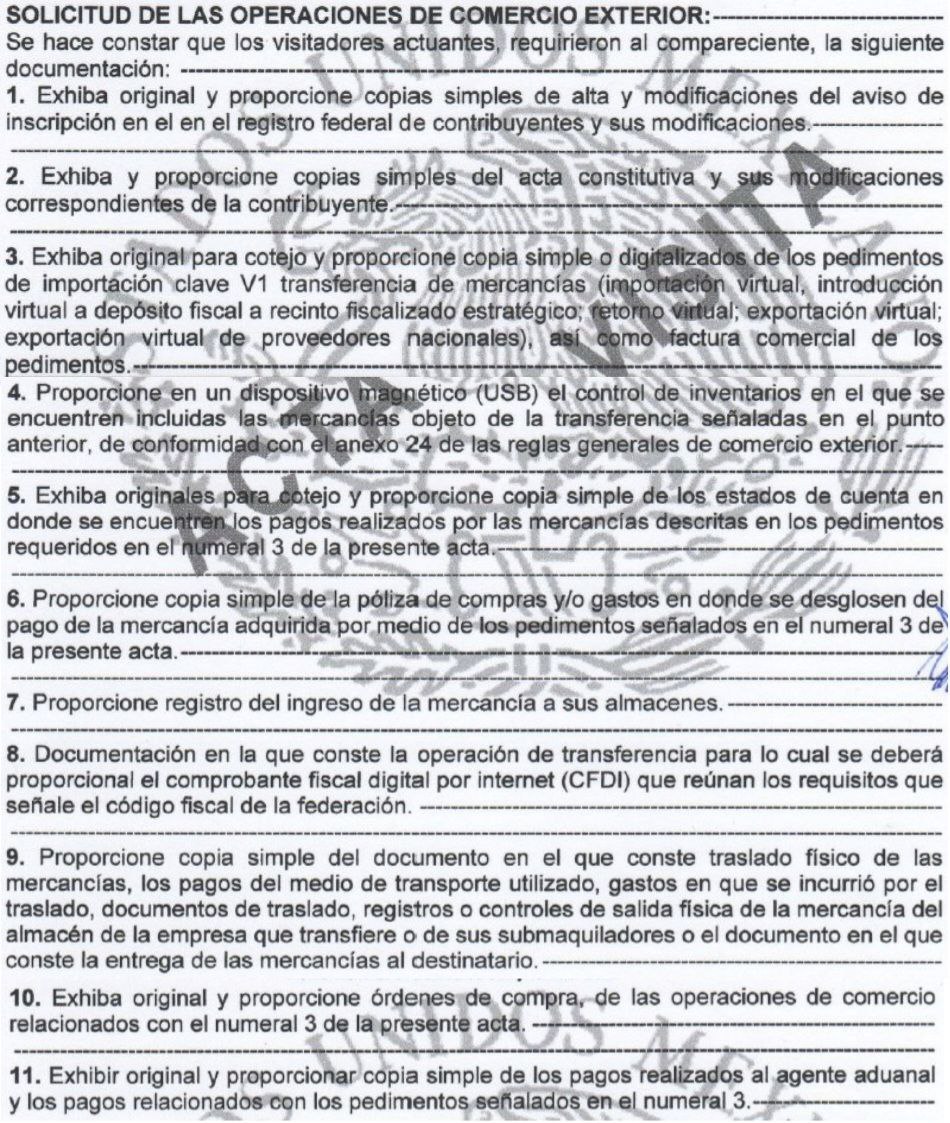

In a very specific way, what the tax authority is requesting to detect if there is simulation of virtual operations is the following:

WHAT IS THE AUTHORITY LOOKING FOR?

Considering the above, what the authority is looking for in a very specific way is:

-

Discrepancies: Any discrepancy in the documentation and information provided in order to not consider the transfer valid. It is important to note that the search for these discrepancies is not limited to the audited companies, but is reaching the companies with which operations are carried out with a V1 key, through the verifications.

-

Deadlines: that the deadlines for submitting petitions for modulation or for returning abroad or changing the regime have not been exceeded.

-

RRNA's: that the corresponding non-tariff regulations and restrictions have been complied with.

You want t know more about Virtual Operations visit our Webinar The Labyrinth Of Virtual Operations And How To Get Out Of Them!

WHAT CONSEQUENCES DOES IT BRING NOT TO HAVE THE TRANSFER VALID?

Not considering the transfer valid essentially has 2 consequences:- that the goods are considered non-returned or exported.

- that the authority determines a payment of contributions, as well as its accessories, for the merchandise that is considered non-returned.

In addition to the above, if you are an IMMEX company or you are certified in terms of VAT and IEPS, it is possible that you fall into some suspension and/or cancellation case.

WHAT SHOULD I DO IF I AM STILL NOT CHECKED?

Remember that according to the current RGCE, for the authority to consider the virtual transfer as valid, you must essentially cover the following four points:- that virtual transfers are in Annex 24.

- that CFDI has been issued, in accordance with the fiscal requirements indicated by the CFF.

- that the physical transfer of the merchandise object of virtual transfer is accredited

- that the merchandise has been subjected to a production process.

WHAT SHOULD I DO IF I AM ALREADY REVIEWED?

Essentially remember that this is a verification power that the authority has, in order to verify that the operations have been carried out correctly, for which we suggest the following:

-

Keep calm, receive the subpoena (if applicable), as well as the order.

-

Provide the information that they are requesting, as long as it is within the ranges indicated in the verification order itself and the law.

-

Present the evidence or arguments at the appropriate procedural moments, depending on the review procedure to which you are subject.

-

If you have any further questions, you can watch the video on “THE LABYRINTHS OF VIRTUAL OPERATIONS AND HOW TO GET OUT OF THEM”

AND IF AN IRREGULARITY IS DETECTED, WHAT DO I DO?

It is important to point out that each matter is different, so the particularities of each one should be analyzed, however it is important that in the case of virtual operations you can always carry out the regularization of the merchandise and in the event that the The AGACE or ADACE determines a tax credit for you, you can always challenge it through the appeal for revocation or the nullity trial.

Finally, remember that these are procedures, which the authority must adjust to the corresponding legal precepts, if you consider that there is any violation of them or excess by the Authority, contact us and we can gladly help you out of this mess.

Contact us and find out! You can request advice from us, just click here and we will guide you so that you know how to act before these audits. The most important thing, and we always remind our clients, is to carry out risk management on your compliance obligations. Ask about our automated management for your company's document operations.

Similarly, consult our Webinar: Request for Rectification. The lethal weapon against your carelessness finable by the Authority! where we talk about the process of rectifying petitions and how this can be your most powerful weapon against these audits by the SAT.

Do not hesitate to contact us, at MDI Trade Solutions we are here to help you.

Contact us and find out! You can request advice from us, just click here and we will guide you so that you know how to act before these audits. The most important thing, and we always remind our clients, is to carry out risk management on your compliance obligations. Ask about our automated management for your company's document operations.

Similarly, consult our Webinar: Request for Rectification. The lethal weapon against your carelessness finable by the Authority! where we talk about the process of rectifying petitions and how this can be your most powerful weapon against these audits by the SAT.

Do not hesitate to contact us, at MDI Trade Solutions we are here to help you.